In the rapidly evolving landscape of financial services, technology has become the catalyst for transformative change. Fintech, short for financial technology, is at the forefront of this revolution, reshaping how we manage and interact with our finances. One of the pivotal elements of this transformation is Fintech App Development.

Introduction:

In recent years, the surge in Fintech App Development has revolutionized the financial sector, offering innovative solutions that enhance user experience, streamline processes, and democratize access to financial services.

The Rise of Fintech:

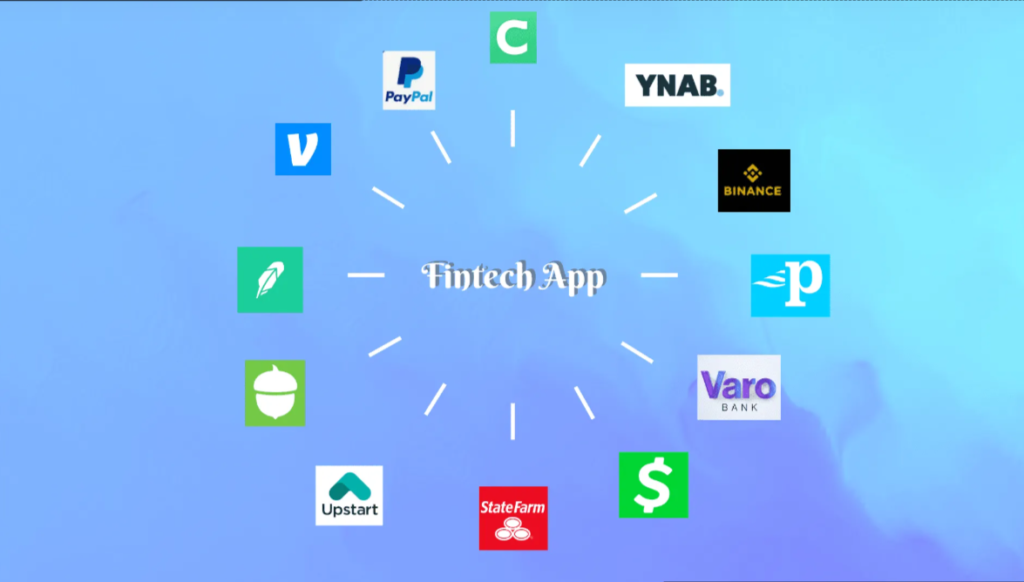

Fintech, a fusion of finance and technology, encompasses a diverse range of services. From payment solutions and personal finance management to investment platforms and blockchain applications, Fintech has disrupted traditional financial models.

Key Components of Fintech App Development:

User-Centric Design:

- Fintech apps prioritize user experience. A seamless and intuitive interface is crucial for engaging users and encouraging adoption. Design thinking is employed to create apps that address specific financial pain points and provide solutions with simplicity and clarity.

Security and Compliance:

- With the handling of sensitive financial information, security is paramount. Fintech apps implement robust security measures, including encryption protocols and secure authentication methods, to protect user data. Compliance with regulatory standards is meticulously followed to ensure trust and reliability.

Innovative Payment Solutions:

- Fintech apps are redefining the way we make payments. From mobile wallets and contactless payments to peer-to-peer transactions, these apps offer convenient, efficient, and secure alternatives to traditional banking methods.

- Innovative payment solutions represent a transformative wave in the financial landscape, redefining the way individuals and businesses conduct transactions. These solutions leverage cutting-edge technologies to enhance the speed, security, and convenience of payment processes. From mobile wallets and contactless payments to cryptocurrency transactions and peer-to-peer transfers, the realm of innovative payment solutions is vast and dynamic.

Data Analytics and Personalization:

- Fintech apps leverage advanced data analytics to understand user behavior and preferences. This data is then utilized to provide personalized financial insights, recommendations, and customized services, enhancing the overall user experience.

Blockchain Technology:

- The adoption of blockchain technology has brought transparency and security to financial transactions. Fintech apps exploring blockchain facilitate decentralized and tamper-proof systems, enabling efficient and secure transactions.

- Blockchain technology, often hailed as a revolutionary force, is a decentralized and distributed ledger system that underlies cryptocurrencies like Bitcoin and Ethereum. It operates as a secure and transparent chain of blocks, each containing a record of transactions linked through cryptography.

Challenges and Opportunities:

Regulatory Landscape:

- Fintech operates within a complex regulatory environment. Adhering to regulatory requirements is a challenge, but it also presents an opportunity for Fintech App Developers to demonstrate commitment to compliance and build trust among users.

Cybersecurity Risks:

- As financial transactions move online, the risk of cybersecurity threats increases. Fintech App Developers must continuously update security protocols to stay ahead of potential risks and ensure the safety of user data.

Future Trends in Fintech App Development:

Artificial Intelligence (AI) Integration:

- AI-powered features, such as chatbots and virtual assistants, are becoming integral to Fintech apps, providing personalized customer support and automating routine tasks.

- Artificial Intelligence (AI) integration is a pivotal advancement reshaping various industries by infusing intelligence and automation into systems and processes. This transformative technology involves embedding AI capabilities into existing frameworks, applications, or services, enabling them to perform tasks that traditionally required human intelligence.

Decentralized Finance (DeFi):

- The rise of DeFi is reshaping traditional financial services by enabling peer-to-peer lending, decentralized exchanges, and other financial activities without the need for traditional intermediaries.

Conclusion:

Fintech App Development is a dynamic field driving financial innovation and inclusion. As technology continues to advance, Fintech apps will play an increasingly pivotal role in shaping the future of finance, offering solutions that are not only efficient and secure but also user-friendly and accessible to a broader audience. Embracing the opportunities and challenges of Fintech App Development is key to unlocking the full potential of this transformative industry.

More Stories

Singapore Drop Shipping Market Witness Highest Growth at a Considerable CAGR by 2030

How to Develop CRM Software

How to Reset WiFi on Your HP DeskJet 2752e Printer